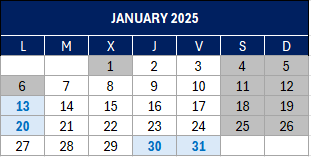

Taxpayer Calendar / January 2025:

(Source: Agencia Tributaria)

Until 13 January

INTRASTAT – Intra-Community Trade Statistics

- December 2024. Obliged to supply statistical information

Until 20 January

Personal Income Tax (IRPF) and Corporate Income Tax (IS)

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from the rental of urban property, movable capital, authorised persons and balances in accounts and income of non-residents obtained without a permanent establishment.

- December 2024. Large companies: 111, 115, 117, 123, 124, 126, 128, 216, 230.

- Fourth quarter 2024: 111, 115, 117, 123, 124, 126, 128, 136, 210, 216.

Value added tax (VAT)

- Notification of incorporations in the month of December, special regime for the group of entities: 039

- Application for refund by taxpayers under the simplified VAT system and who carry out the activity of passenger or goods transport by road, for acquiring certain means of transport: 308

Tax on insurances

- December 2024: 430

Special Manufacturing Taxes

- October 2024. Large companies: 561, 562, 563

- December 2024: 548, 566, 581

- Fourth quarter 2024: 521, 522, 547

- Fourth quarter 2024. Activities V1, F1: 553 (establishments authorised to keep paper-based accounts)

- Fourth quarter 2024. Refund applications: 506, 507, 508, 524, 572

- Declaration of transactions by registered recipients and tax representatives: 510

Special Tax on Electricity

- December 2024. Large companies: 560

- Fourth quarter 2024. Except large companies: 560

Environmental Taxes

- December 2024. Special tax on non-reusable plastic packaging. Self-assessment: 592

- Fourth quarter 2024. Tax on Fluorinated Greenhouse Gases. Self-assessment: 587. Refund application: A23. Submission of stock accounting

- Fourth quarter 2024. Excise tax on non-reusable plastic packaging. Self-assessment: 592. Application for refund: A22.

- Year 2024. Tax on the production of spent nuclear fuel and radioactive waste resulting from the generation of nuclear electricity. Production of radioactive waste. Self-assessment: 584

- Year 2024. Tax on the storage of spent nuclear fuel and radioactive waste in centralised facilities. Annual self-assessment: 585

Special Tax on Coal

- Fourth quarter 2024: 595

- Year 2024. Annual declaration of operations: 596

Financial Transaction Tax

- December 2024: 604

Until 30 January

Instalments of Personal Income Tax (IRPF) payments

- Fourth quarter 2024:

- Direct assessment: 130

- Objective assessment: 131

Value Added Tax (VAT)

- December 2024. Self-assessment: 303

- December 2024. Group of entities, individual form: 322

- December 2024. Recapitulative return for intra-Community transactions: 349.

- December 2024. Group of entities, aggregate form: 353

- December 2024 (or year 2024). Operations assimilated to imports: 380

- Fourth quarter 2024. Self-assessment: 303

- Fourth quarter 2024. Non-periodic declaration-settlement: 309

- Fourth quarter 2024. Recapitulative return for intra-Community transactions: 349.

- Fourth quarter 2024. Transactions treated as imports: 380

- Annual summary 2024: 390

- Application for refund of tax reimbursed to travellers by entrepreneurs subject to the equivalence surcharge: 308

- Regularisation of taxation proportions for settlement periods prior to the commencement of the usual supply of goods or services: 318

- Reimbursement of compensation under the special scheme for agriculture, livestock farming and fishing: 341

- Option or revocation of the application of the special deductible proportion for 2025 and subsequent years, if the activity started in the last quarter of 2024: 036/037

Environmental taxes

- Fourth quarter 2024. Tax on the deposit of waste in landfills, incineration and co-incineration of waste. Self-assessment: 593

Until 31 January

Personal Income Tax (IRPF)

Waiver or revocation of objective estimation for 2025 and subsequent years: 036/037

Personal Income Tax (IRPF) and Corporation Tax (IS)

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from leasing of urban property, movable capital, authorised persons and balances in accounts.

- Annual summary 2024: 180, 188, 190, 190, 193, 193-S, 194, 196, 270

Income of non-residents without permanent establishment

Special tax on real estate of non-resident entities 2024: 213

Withholdings and payments on account of non-resident income tax (without permanent establishment)

- Annual summary 2024: 296

Transactions with financial assets

- Annual declaration of transactions with Treasury Bills 2024: 192

- Annual return on transactions with financial assets 2024: 198

Value-added tax (VAT)

- Renunciation or revocation of the simplified system and agriculture, livestock and fishing for 2025 and subsequent years: 036/037

- Request for application of the provisional deduction percentage different from the one set as definitive in the preceding year: no form

- December 2024. One-stop Shop – Import Regime: 369

- Fourth quarter 2024: One-stop shop – Foreign and Union Regimes: 369

Insurance Premium Tax

- Annual Summary 2024: 480

Tax on Certain Digital Services

- Fourth quarter 2024: 490

Environmental taxes

- December 2024. Excise tax on non-reusable plastic packaging. Accounting and stock record book submission

- Fourth quarter 2024. Excise tax on non-reusable plastic packaging. Presentation of accounts and stock record book

Informative return of individual certificates issued to members or participants of new or recently created entities

- Annual summary 2024: 165

Annual information return on deposits, withdrawals and cash withdrawals of any document

- Year 2024: 171

Information return on balances in virtual currencies and on transactions with virtual currencies

- Year 2024: 172, 173

Information return on loans and credits and other financial transactions relating to immovable property

- Annual return 2024: 181

Information return on donations, gifts and contributions received and disposals made

- Annual return 2024: 182

Information return for entities under the income attribution regime

- Year 2024: 184

Information return on acquisitions and disposals of shares and holdings in Collective Investment Undertakings

- Annual return 2024: 187

Information return for expenses in nursery schools or authorised child education centres

- Annual return 2024: 233

Information return updating certain tradable cross-border mechanisms

- Fourth quarter 2024: 235

Information return for the communication of information by platform operators

- Year 2024: 238

Quarterly information return on trade operations in tangible goods carried out in the Canary Islands special zone without the goods transiting through Canary Islands territory

- Fourth quarter 2024: 281

Information return on non-resident accounts

- Year 2024: 291

Pension plans, pension funds, alternative systems, social welfare mutual societies, insured pension plans, individual systematic savings plans, company social welfare plans and dependency insurance

- Annual return 2024: 345

Information return on cross-border payments

- Fourth quarter 2024:379