Informative news

Nationals

- Forms 200 and 220 for tax periods commencing between 1 January and 31 December 2024. [Info]

Approval of the corporate income tax and non-resident income tax return forms applicable to permanent establishments and entities under the income attribution system incorporated abroad with presence in Spain, corresponding to tax periods commencing between the 1st of January and the 31st of December 2024.

Order HAC/657/2025, of the 21st of June, approving the tax return forms.

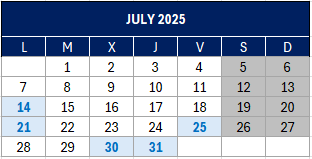

- Declarations and self-assessments with a filing deadline of July 2025. [+Info]

- Magazine ‘Tax & Economic News’ of Morera Asesores. [+Info]

- The DGT clarifies the Personal Income Tax taxation of compensation for loss of profit paid to professionals after the ending of a commercial contract. [+Info]

- The DGT clarifies the VAT tax treatment for the transfer of students between driving schools. [+Info]

- The order regulating the model and deadlines for the transmission of data on short-term rentals to the Digital One-Stop Shop has been published. [+Info]

- The Spanish Association of Tax Advisors (AEDAF) defends respect for jurisprudence as an essential pillar of the tax system. [+Info]

- The Constitutional Court unanimously rejects the conflict between the Government and the Senate on the repeal of the Inheritance and Gift Tax. [+Info]

International

- EFRAG (European Financial Reporting Advisory Group) has approved the updated composition of the academic panel to foster collaboration on financial and sustainability reporting. [+Info]

- The IASB (International Accounting Standards Board) has presented examples for improving the reporting of uncertainties in financial statements, illustrated with climate scenarios. [+Info]

- The IASB has published a request for information as part of its post-implementation review of IFRS 16 Leases. [+Info]

Tax Agency queries of interest

- Subdirectorate General for Personal Income Tax.

On 29/11/2018 and 04/03/2021, the taxpayer (as the selling party) signed contracts for the sale and purchase of shares in a company, which included a non-competition and non-solicitation clause, the breach of which entailed the payment of damages. As a result of an alleged breach of that clause, an arbitration procedure was initiated which ended with the signing of a settlement agreement, which was made public on the 17th of May 2024, establishing the obligation of the consultant to pay compensation. He questions the possible consideration of the compensation as a capital loss for personal income tax purposes.

Binding consultation of the Directorate General of Taxes no. V0023-25. [+Info]

- Subdirectorate General for Financial Operations.

The applicant, holder of two insured pension plans taken out in 2012 and 2019, retired in 2023. She plans to redeem both plans in the form of capital and asks whether the 40% reduction provided for in the transitional personal income tax regime is applicable.

Binding consultation of the Directorate General of Taxes no. V0041-25. [+Info]

Barcelona, 2nd of July 2025.