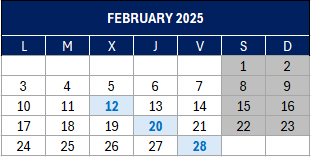

Taxpayer’s calendar

(Source: Agencia Tributaria)

Until 12 February

INTRASTAT – Intra-Community Trade Statistics

- January 2025. Obliged to supply statistical information

Until 20 February

Income and Companies

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from the rental of urban property, movable capital, authorised persons and balances in accounts and income of non-residents obtained without a permanent establishment.

- January 2025. Large companies: 111, 115, 117, 123, 124, 126, 128, 216, 230

Tax Identification Number (TIN)

- Fourth quarter 2024. Quarterly return of accounts and transactions whose holders have not provided their TIN to credit institutions: 195.

- Annual return 2024. Identification of cheque transactions with credit institutions: 199

Value Added Tax (VAT)

- January 2025. Recapitulative return for intra-Community transactions: 349

- Application for refund by taxpayers under the simplified VAT system who carry out the activity of transporting passengers or goods by road, for acquiring certain means of transport: 308

Subsidies, compensation or aid for agricultural, livestock or forestry activities

- Annual return 2024: 346

Tax on insurance premiums

- January 2025: 430

Manufacturing Excise Duties

- November 2024. Large companies: 561, 562, 563

- January 2025: 548, 566, 581

- Fourth quarter 2024. Except large companies: 561, 562, 563

- Declaration of transactions by registered recipients and tax representatives: 510.

Special Tax on Electricity

- January 2025. Large companies: 560

Environmental Taxes

- January 2025. Special tax on non-reusable plastic packaging. Self-assessment: 592

- Year 2024. Tax on the value of electricity production. Fourth instalment payment: 583

Tax on Financial Transactions

- January 2025: 604

Until 28 February

Value Added Tax (VAT)

- January 2025. Self-assessment: 303

- January 2025. Group of entities, individual form: 322

- January 2025. Group of entities, aggregate form: 353

- January 2025. One-stop shop – import regime: 369

- January 2025. Transactions assimilated to imports: 380

Corporate income tax

- Entities whose tax year coincides with the calendar year: option/waiver of the option to calculate the instalments on the part of the tax base for the three, nine or eleven months of each calendar year: 036.

- If the tax period does not coincide with the calendar year, the option/waiver for this type of instalment payment shall be exercised in the first two months of each tax period or between the start of the tax period and the end of the period for making the first instalment payment, if this period is less than two months: 036.

Environmental Taxes

- January 2025. Special tax on non-reusable plastic packaging. Submission of accounting and stock record book

Annual declaration of electricity consumption

- Year 2024: 159

Annual information return on transactions carried out by business people or professionals adhering to the system for managing payments by credit or debit cards.

- Year 2024: 170

Annual informative return on long-term savings plans

- Year 2024: 280

Annual tax return on transactions with third parties

- Year 2024: 347

Self-assessment of the contribution to be made by providers of the television audiovisual communication service and by providers of the video exchange service through a platform with a national geographic scope or greater than that of an Autonomous Community.

- Year 2024: 792