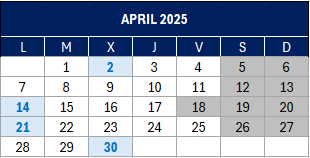

Taxpayer’s calendar

(Source: Tax Agency)

From 2 April to 30 June

Personal Income Tax (IRPF) and Wealth Tax (IP)

- Internet filing of Income Tax 2024 and Wealth Tax 2024 returns

With result to be paid by direct debit, until 25 June

Until 14 April

INTRASTAT – Intra-Community Trade Statistics

- March 2025. Obliged to supply statistical information

Until 21 April

Personal Income Tax (IRPF) and Corporate Income Tax (IS)

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from the rental of urban property, movable capital, authorised persons and balances in accounts and income of non-residents obtained without a permanent establishment.

- March 2025. Large companies: 111, 115, 117, 123, 124, 126, 128, 128, 216, 230

- First quarter 2025: 111, 115, 117, 123, 124, 126, 128, 128, 136, 210, 216

Personal Income Tax (IRPF) instalment payments

- First quarter 2025:

- Direct assessment: 130

- Objective assessment: 131

Corporate Income Tax (IS) instalments and permanent establishments of non-residents

- Current year:

- General regime: 202

- Tax consolidation regime (tax groups): 222

Value Added Tax (VAT)

- March 2025. Recapitulative declaration of intra-Community operations: 349

- First quarter 2025. Self-assessment: 303

- First quarter 2025. Non-periodic return-settlement: 309

- First quarter 2025. Recapitulative return for intra-Community transactions: 349

- First quarter 2025. Operations assimilated to imports: 380

- Application for a refund of quotas reimbursed to travellers by taxable persons under the equivalence surcharge: 308

- Application for refunds by taxpayers under the simplified VAT regime and who carry out the activity of passenger or goods transport by road, for acquiring certain means of transport: 308

- Refund of compensation in the special regime for agriculture, livestock and fisheries: 341

Tax on insurance premiums

- March 2025: 430

Special Manufacturing Taxes

- January 2025. Large companies: 561, 562, 563

- March 2025: 548, 566, 581

- First quarter 2025: 521, 522, 547

- First quarter 2025 Activities V1, F1: 553 (establishments authorised to keep paper-based accounts).

- First quarter 2025. Refund applications: 506, 507, 508, 524, 572

- Declaration of transactions by registered recipients and tax representatives: 510

Excise Tax on Electricity

- March 2025. Large companies: 560

- First quarter 2025. Except large companies: 560Year 2024. Annual self-assessment: 560

Environmental Taxes

- March 2025. Special tax on non-reusable plastic packaging. Self-assessment: 592

- First quarter 2025. Tax on fluorinated greenhouse gases. Self-assessment: 587. Refund request: A23. Submission of stock accounting

- First quarter 2025. Excise tax on non-reusable plastic packaging. Self-assessment: 592. Refund application: A22.

- Year 2024. Tax on the Value of Gas, Oil and Condensate Extraction. Annual self-assessment: 589

- Year 2025. Tax on the storage of spent nuclear fuel and radioactive waste in centralised facilities. First instalment payment 585

Coal Excise Duty

- First quarter 2025: 595

Financial Transaction Tax

- March 2025: 604

Contribution to be made by television audiovisual communication service providers and by video exchange service providers through a platform with a national geographical scope or greater than that of an Autonomous Community.

- Payment on account 1P 2025: 793

Until 30 April

Value Added Tax (VAT)

- March 2025. Self-assessment: 303

- March 2025. Group of entities, individual form: 322

- March 2025. Group of entities, aggregate form: 353

- March 2025. Single window – Import Regime: 369

- March 2025. Transactions assimilated to imports: 380

- First quarter 2025: One-stop shop – External and Union regimes: 369

Tax Identification Number (TIN)

- First quarter 2025. Accounts and transactions whose holders have not provided their TIN to the credit institutions: 195

Tax on Certain Digital Services

- First quarter 2025: 490

Environmental Taxes

- March 2025. Special tax on non-reusable plastic packaging. Presentation of accounting and stock record book

- First quarter 2025. Special tax on non-reusable plastic packaging. Presentation of accounts and stock ledger

- First quarter 2025. Tax on the deposit of waste in landfills, incineration and co-incineration of waste. Self-assessment: 593

Information return for updating certain tradable cross-border mechanisms.

- First quarter 2025: 235

Quarterly information return on transactions involving trade in tangible goods carried out in the Canary Islands special zone without the goods transiting through Canary Islands territory.

- First quarter 2025: 281

Information return on cross-border payments

- First quarter 2025: 379