Taxpayer’s calendar

(Source: Agencia Tributaria)

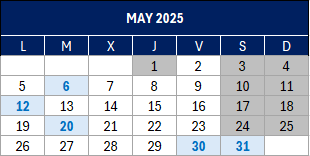

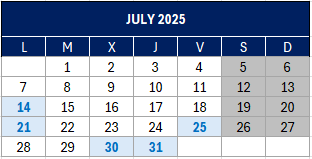

From 6th of May to 30th of June

Filing of the Personal Income Tax (IRPF) of 2024 by phone.

Until 12th of May

INTRASTAT – Intra-Community Trade Statistics

- April 2025. Obliged to provide statistical information

Until 20th of May

Personal Income Tax (IRPF) and Corporate Income Tax (IS)

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from the rental of urban property, movable capital, authorised persons and balances in accounts and income of non-residents obtained without a permanent establishment.

- April 2025. Large companies: 111, 115, 117, 123, 124, 126, 128, 216, 230

Value Added Tax (VAT)

- April 2025. Recapitulative return of intra-Community transactions: 349

- Application for refund by taxpayers under the simplified VAT system and who carry out the activity of passenger or goods transport by road, for acquiring certain means of transport: 308

Tax on Insurance Premiums

- April 2025: 430

Special Manufacturing Taxes

- February 2025. Large companies: 561, 562, 563

- April 2025: 548, 566, 581

- First quarter 2025. Except for large companies: 561, 562, 563

- Declaration of transactions by registered recipients and tax representatives: 510.

Special Tax on Electricity

- April 2025. Large companies: 560

Environmental Taxes

- April 2025. Special tax on non-reusable plastic packaging. Self-assessment: 592

- Year 2025. Tax on the value of electricity production. First instalment payment: 583

Tax on Financial Transactions

- April 2025: 604

Until 30th of May

Value Added Tax (VAT)

- April 2025. Self-assessment: 303

- April 2025. Group of entities, individual form: 322

- April 2025. Group of entities, aggregate form: 353

- April 2025. Transactions assimilated to imports: 380

Until 31st of May

Value Added Tax (VAT)

- April 2025. One-stop shop – Import regime: 369