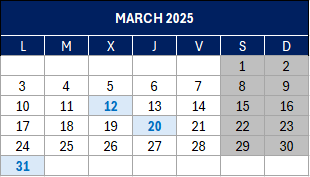

Spanish Taxpayer Calendar

(Source: Spanish Tax Agency)

Until the 5th of November

Personal Income Tax (IRPF)

- Payment of the second instalment of the 2023 annual tax return, if payment has been made in instalments: 102

Until the 12th of November

INTRASTAT – Intra-community Trade Statistics

- October 2024. Obliged to provide statistical information

Until the 20th of November

Personal Income Tax and Corporate Income Tax (IRPF and IS)

Withholdings and payments on account of income from work, economic activities, prizes and certain capital gains and imputations of income, gains derived from shares and holdings in Collective Investment Institutions, income from the rental of urban property, movable capital, authorised persons and balances in accounts.

- October 2024. Large companies: 111, 115, 117, 123, 124, 126, 128, 216, 230

Value added tax (VAT)

- October 2024. Recapitulative declaration of intra-Community transactions: 349.

Tax on Insurance Premiums

- October 2024: 430

Manufacturing Excise Duties

- August 2024. Large companies: 561, 562, 563

- October 2024: 548, 566, 581.

- Third quarter 2024. Except for large companies: 561, 562, 563

- Declaration of transactions by registered recipients, tax representatives and authorised recipients: 510.

Special Tax on Electricity

- October 2024. Large companies: 560

Environmental Taxes

- October 2024. Special tax on non-reusable plastic packaging. Self-assessment: 592

- Year 2024. Tax on the value of electricity production. Third instalment payment: 583

Tax on Financial Transactions

- October 2024: 604

Until the 30th of November

Value Added Tax (VAT)

- October 2024 One-stop shop – import regime: 369